As we have all heard by now, many of the large lenders have indicated that settlement agents will not prepare the Closing Disclosures to be delivered to borrowers. Please note that the new certification contains the language “which I have prepared”. I further certify that I have obtained the above certifications which were executed by the borrower(s) and seller(s) as indicated.”

“To the best of my knowledge, the Closing Disclosure which I have prepared is a true and accurate account of the funds which were (i) received, or (ii) paid outside closing, and the funds received have been or will be disbursed by the undersigned as part of the settlement of this transaction. The new certification is intended to replace FHA’s current addendum to the HUD-1 Settlement Statement and will be used for the new Closing Disclosures once the TRID rules become effective. The Federal Housing Administration (FHA) released a new settlement certification this summer in anticipation of the implementation of the TRID rules on October 3. Title insurance companies are excellent sources of information and training on these topics! Call on them!įHA answers a FAQ it doesn’t officially change the certification One incident could easily put a law firm out of business.

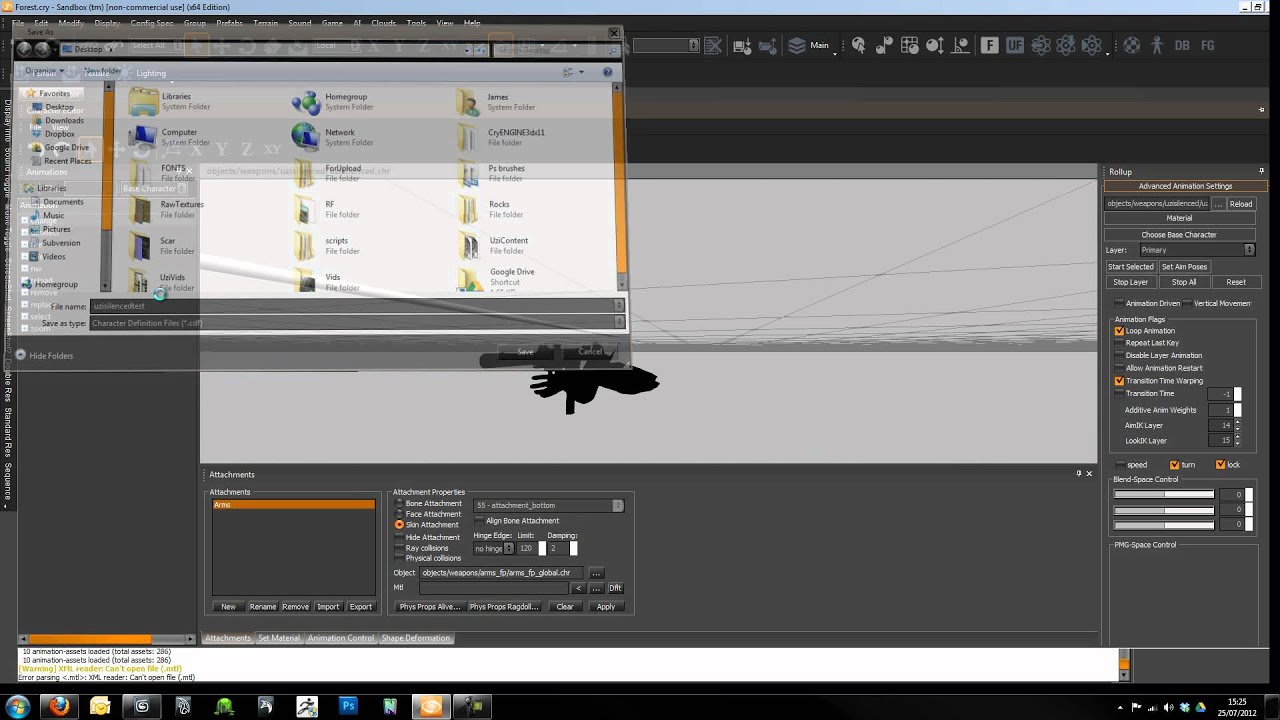

#Softpro and cdf files update

Please remain vigilant! Read everything you can on this topic, and continue to update and guard your systems. If you suspect fraud, contact the bank immediately.A good practice would be to refrain from sending wiring instructions by e-mail. Always assume e-mail has been compromised, and validate the information by phone. Never wire funds based on the content of an e-mail.Use an e-mail system that requires two-factor authentication.Here are three pieces of advice for all closing attorneys: This document provides two cyber incident checklists, one for use in preparing, and the other for use if your office is attacked. The second document was prepared by Linda Grahovec, the Director of Education and Marketing for our company. This PSA states that the total number of victims from October 2013 through August 2015 was 8,179 and the total exposed dollar loss was $798,897,959! We have seen this happen in more than one law firm in South Carolina! Legitimate e-mail accounts are compromised through social engineering and computer intrusion to conduct unauthorized wire transfers. BEC is defined as a sophisticated scam targeting businesses working with foreign suppliers and businesses that regularly perform wire transfers. The first document is a Public Service Announcement from the FBI dated Augconcerning Business Email Compromise (BEC). With the increase in wire fraud that is happening in closing offices around the country, our company recently shared two documents that I thought would be beneficial to pass along to all South Carolina dirt lawyers. Tyler Temple on SC Supreme Court Warns Closing…Īnd what to do if you suspect a compromise Henrietta Gill on SC Supreme Court probate case…Ĭlaire Manning on Here’s a new wrinkle in real e… SC Supreme Court probate case is real estate adjacentĬlaire Manning on SC Supreme Court probate case….Murrells Inlet commercial neighbors embroiled in litigation.Easements don’t typically lead to criminal contempt charges.SC Supreme Court issues one more opinion on the Episcopal church controversy.Failure to search title leads to disastrous result.Dig Through the Dirt Search for: Recent Dirt

0 kommentar(er)

0 kommentar(er)